Overview of the Tax List Law

A good source of genealogical information may be found in the various county tax lists. Kentucky is one of the few states that offers the researcher an excellent listing of the early settlers along with other interesting information.

If you are working to overcome a brick wall, have you consulted the county tax list? These lists are often by year. If your ancestor moved through the county, the family may not be listed in the census but might appear on this list.

All the counties that came into existence in 1792 have tax lists available (some counties have earlier dates). However, some years are missing, and some pages are difficult to read. In 1781, Virginia tax laws applicable to Kentucky stated,

“That court of every county will divide the same into precincts and annually before the tenth day of April appoint one justice for each precinct to take a tax list of the names of all free male persons above the age of twenty-one.”

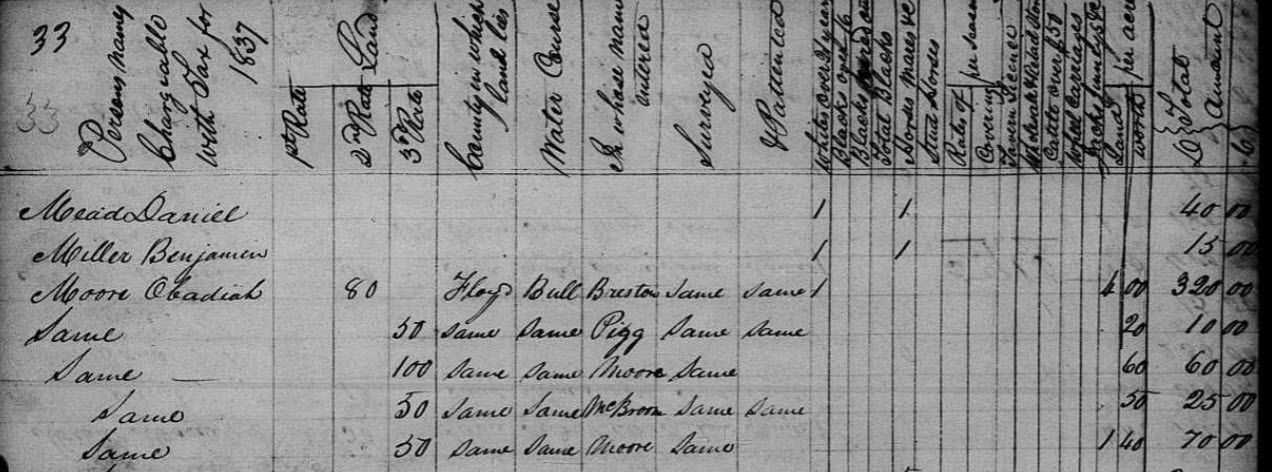

The tax list shows the number of acres of land owned and where located (county and watercourse); name of surveyor; and name of the person who entered the land. It will also contain the number of slaves, cattle, and horses; wheels of riding carriages; billiard tables and ordinary (tavern) licenses.

1837 Tax List from Floyd County, Kentucky [Source: FamilySearch International]

What Data is in the Tax List

The tax list was by households where land was owned. Each white male should have appeared on the tax list when he became twenty-one years of age, whether or not he owned property. All white males of twenty-one years were liable for a poll-tax. A woman or free black appeared only if they owned land.

When a man’s son turned twenty-one, he would appear on the tax list, usually listed with his father. When a man died, his widow usually appeared on the list if he owned land. She remained on the tax list until the estate was settled or she remarried.

Tip! Tax lists often show persons not listed on the census, since many people moved between census years.

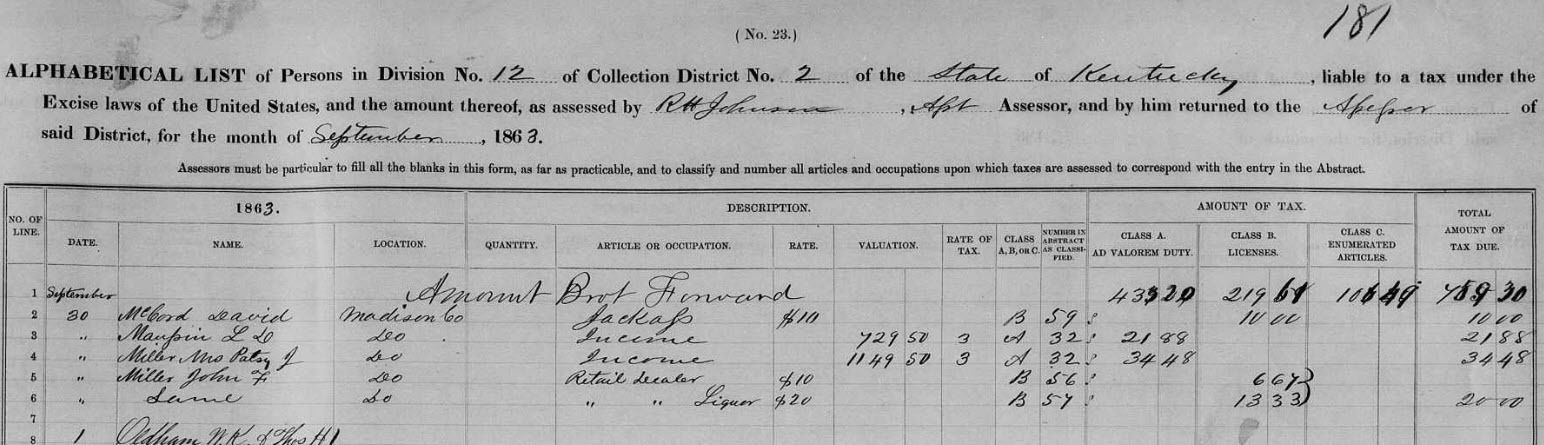

Breathitt County Assessment List, 1863 Source: FamilySearch

Tax List Exemptions

There were several reasons a man would be exempt from the tax list. Here are a few of the reasons:

- If he was a minister

- If he was war veteran (Revolutionary or French and Indian War)

- If a man was deceased and his tax was paid by his estate. If the surname had a “white male tithable over 16 years old”, then he may have left a son. At least someone in the house was being taxed

- If a widow had someone in her family taxed, then she also must have had a male over 16 living in her household, perhaps a son

- If he was too poor and not able to work

Look in the county court orders, if they exist for your county, to find exemptions.

Viewing the Kentucky Records by County

The Kentucky counties were organized into districts. In 1862, there were four districts. Two more were added in 1864 and three more in 1866. Many of the counties moved between the districts so one must pay attention. For instance, Allen County was in the 1st, 2nd, and 4th districts depending on the year.

The following table contains each district and the counties it contained based on the tax year. Family Search has some of these records but they are not indexed or transcribed. Also, some are missing and sometimes the records are not in order.

| District | 1862 | 1864 | 1866 |

|---|---|---|---|

| First District |

|

|

|

| Second District |

|

|

|

| Third District |

|

|

|

| Fourth District |

|

|

|

| Fifth District | Established in 1864 |

|

|

| Sixth District | N/A – Established in 1864 |

|

|

| Seventh District | District Established in 1866 | District Established in 1866 |

|

| Eighth District | District Established in 1866

Note: No records exist for this district |

District Established in 1866 |

|

| Ninth District | District Established in 1866 | District Established in 1866 |

|

Reference

- History of Kentucky Taxation

- YouTube from KDLA: Overview of Early Kentucky Tax Records

Editor’s Notes

We updated Mr. Thompson’s post with the Family Search information that was not available when he originally wrote the post.